Empowering an Impact Economy

for our common Future

Who

WHO WE ARE

About Alexander Raquet

As Commercial Officer of the Karlsruhe-based family office 4L Vision GmbH of entrepreneur Ralph Suikat, Alexander Raquet is, among other things, responsible for administration and operation of the organisation and for the marketing activities of 4L Vision GmbH itself. He also advises the 4L subsidiaries, which together form the 4L Impact Family, an action-focussed entrepreneurial network with social, societal and ecological impact. He further provides support in these areas to various 4L Vision holdings.

Alexander is a sales, marketing and operations professional with extensive experience and a successful track record in building, improving efficiency and leadership in well-known internationally active companies in the digital economy. In order to achieve real and lasting impact, he is driven to combine significant scaling effects for innovative business models with deep social and environmental thinking in order to achieve real and lasting impact. This is the primary motivation in all his professional and private projects, evidenced not only by his work for the 4L Group as part of the impact economy, but also by his private activities for the preservation, building and expansion of democracy and human rights.

Commercial Director

About Alexander Raquet

As Commercial Officer of the Karlsruhe-based family office 4L Vision GmbH of entrepreneur Ralph Suikat, Alexander Raquet is, among other things, responsible for administration and operation of the organisation and for the marketing activities of 4L Vision GmbH itself. He also advises the 4L subsidiaries, which together form the 4L Impact Family, an action-focussed entrepreneurial network with social, societal and ecological impact. He further provides support in these areas to various 4L Vision holdings.

Alexander is a sales, marketing and operations professional with extensive experience and a successful track record in building, improving efficiency and leadership in well-known internationally active companies in the digital economy. In order to achieve real and lasting impact, he is driven to combine significant scaling effects for innovative business models with deep social and environmental thinking in order to achieve real and lasting impact. This is the primary motivation in all his professional and private projects, evidenced not only by his work for the 4L Group as part of the impact economy, but also by his private activities for the preservation, building and expansion of democracy and human rights.

About Dr. Johannes Knorz, LL.M

Dr. Johannes Knorz, LL.M. is a lawyer specialising in intellectual property law and owner of the commercial and business law firm 4L Legal. He is Managing Director of the family office 4L Vision GmbH and Chairman of the Impact Committee of 4L Capital AG. Johannes strongly believes that a good investment is characterised by more than just a financial return – social or ecological return is at least as important. He therefore leads the family office 4L Vision GmbH together with founder Ralph Suikat with an exclusive focus on impact investing across all asset classes and investments. 4L Vision GmbH is the core of the 4L Impact Family, an action-focussed entrepreneurial network with social, societal and ecological impact and which includes holdings in more than 20 businesses and partner companies. Johannes is author of the essay „Impact Investing in the Single Family Office – an Overview“, which has become a definitive reference for investors.

CEO

About Dr. Johannes Knorz, LL.M

Dr. Johannes Knorz, LL.M. is a lawyer specialising in intellectual property law and owner of the commercial and business law firm 4L Legal. He is Managing Director of the family office 4L Vision GmbH and Chairman of the Impact Committee of 4L Capital AG. Johannes strongly believes that a good investment is characterised by more than just a financial return – social or ecological return is at least as important. He therefore leads the family office 4L Vision GmbH together with founder Ralph Suikat with an exclusive focus on impact investing across all asset classes and investments. 4L Vision GmbH is the core of the 4L Impact Family, an action-focussed entrepreneurial network with social, societal and ecological impact and which includes holdings in more than 20 businesses and partner companies. Johannes is author of the essay „Impact Investing in the Single Family Office – an Overview“, which has become a definitive reference for investors.

About Ralph Suikat

Ralph Suikat, well-known entrepreneur, is founder and managing director of 4L Vision GmbH, Karlsruhe. The family office is the centre of the 4L Impact Family, an action-focussed entrepreneurial network with social, societal and ecological impact, and which comprises holdings in more than 20 businesses and partner companies. Through the pursuit of specific and consistent impact investing objectives for his capital, he gears his entire portfolio towards „making the world a little better“. Ralph firmly believes that impact investing represents an important paradigm shift and a democratisation of the economic and financial order. He aims to demonstrate how this new, big idea can have a positive impact on all areas of life. Ralph, together with Gunther Thies, founded the STP group of companies in 1993 and sold his shares in 2016 for personal reasons. Among other duties, he is chairman of the supervisory boards of 4L Capital AG and Fairantwortung gAG, and is also a shareholder of TechnologieRegion Karlsruhe GmbH.

Gründer, Inhaber und CEO

About Ralph Suikat

Ralph Suikat, well-known entrepreneur, is founder and managing director of 4L Vision GmbH, Karlsruhe. The family office is the centre of the 4L Impact Family, an action-focussed entrepreneurial network with social, societal and ecological impact, and which comprises holdings in more than 20 businesses and partner companies. Through the pursuit of specific and consistent impact investing objectives for his capital, he gears his entire portfolio towards „making the world a little better“. Ralph firmly believes that impact investing represents an important paradigm shift and a democratisation of the economic and financial order. He aims to demonstrate how this new, big idea can have a positive impact on all areas of life. Ralph, together with Gunther Thies, founded the STP group of companies in 1993 and sold his shares in 2016 for personal reasons. Among other duties, he is chairman of the supervisory boards of Fairantwortung gAG, and is also a shareholder of TechnologieRegion Karlsruhe GmbH.

Values

The values that define us are anchored in our name „4L Vision“ – LIVE, LOVE, LEARN, LEAVE A LEGACY. So what would we like to leave behind for future generations?

Stephen Covey, 1932–2012, American author and university lecturer, described the four basic human needs with „four L’s“. The answers to his fundamental questions have the power to bring direction and meaning to our lives and to our business activities.

Live

All should be able to live a life without fear, a life full of dignity and consciousness.

Let’s work towards a good life for all!

Love

The greatest achievements were never truly achieved alone. Love shared is what makes wonders.

So let us unite, and make wonders together.

Learn

All should have access to good education, have the chance to develop as a person and to fulfil their potential.

Let’s be curious!

Leave a legacy

There is no greater gift than the legacy of a life filled with love and learning.

Let us work together to leave behind a better world.

Why

What we stand for

„Putting my money where my meaning is, makes me live who I am.“

Tim Noortman

Mission

Our goal is to both preserve and to build on our capital as a way of achieving an impact and making the world a better place.

We are committed to sustainable business practices and to outcome-oriented impact investing. The impact projects we select all contribute towards resolving a fundamental ecological or social problem.

We commit to using everything at our disposal and at all levels to make impact investing successful and a mainstream concept. Impact investing will move beyond its niche existence when impact portfolios become financially interesting to investors. Therefore, good financial returns are of key importance. In this way, impact investing can deliver the greatest possible effect – for the benefit of everyone and to contribute to the preservation of our natural and basic needs. In this way impact investing promotes a fairer society and healthier environment.

Structure

We achieve social and ecological impact in various investment classes.

Private Equity

Stakes in companies, funds

Public Equity

Listed shares

Fixed Income

Bonds and loans

Real Assets

Real estate

Commodity Investments

Raw materials

Liquidity Portfolio

Liquidity

External Asset Management

External wealth management

How

What we do

„The world’s biggest problems are the world’s biggest market opportunities.“

Peter Diamandis, GIIN (Global Impact Investing Network)

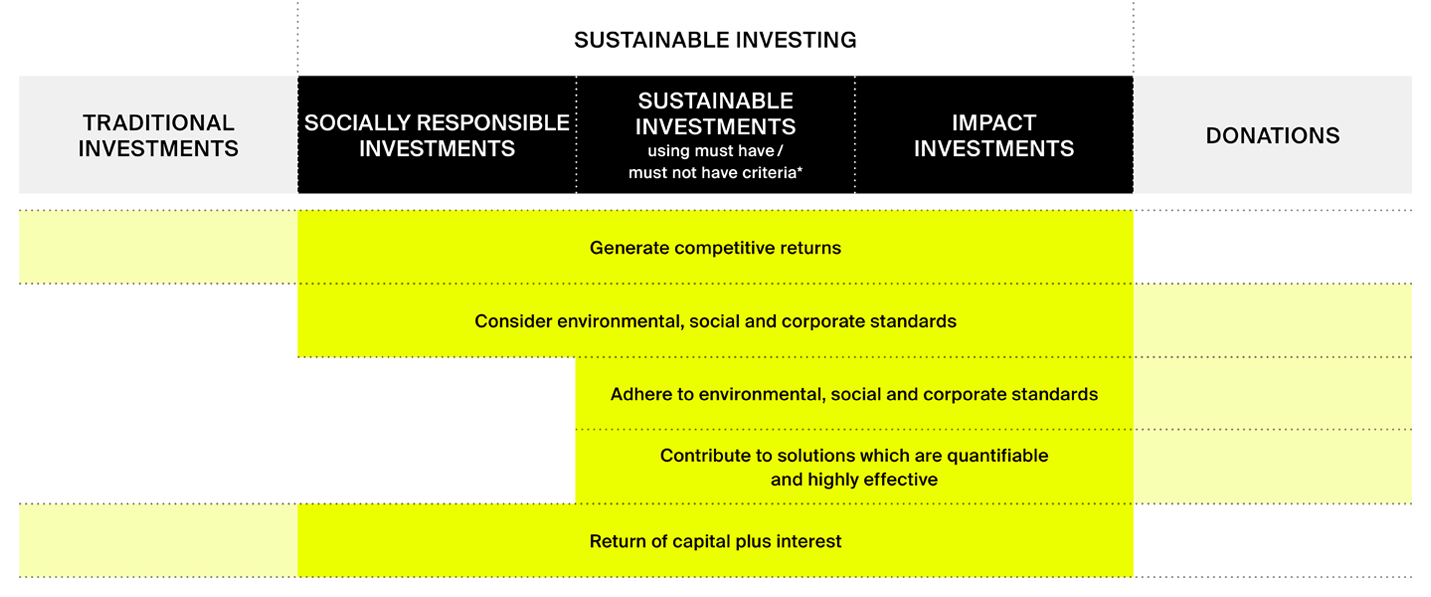

Impact investing: an investment strategy

The term „impact investing“ describes the strategy of investing effectively, measurably and demonstrably in ecological or social projects, while at the same time achieving an attractive and at least „standard market“ return.

Impact investing as a strategy lends a fundamental, competitive advantage to an impact company simply because the focus is sustainability and the company is therefore less susceptible to crises. It is this aspect of risk management that contributes to long-term yields at the level at least of normal market returns.

1

Investing in projects / companies who address a fundamental environmental, social or governance issue

2

Using UNESCO’s 17 goals for sustainable development, known as “Social Development Goals” (SDG) as an essential guide to identify opportunities

3

Progress towards achieving the outcomes must be measurable and scalable (known as impact measurement)

4

The project / company must work with complete transparency towards these outcomes

5

The aim of the investment is to generate a competitive risk-adjusted returns in addition to the environmental, social and governance returns. The overall return is assessed in accordance with the investments’ Risk / Return / Impact profile (RRI).

Impact investing makes the difference

*stipulation not to violate certain ecological, social and corporate standards (negative catalogue) or to explicitly pursue positive criteria (positive catalogue).

The key strength of impact investing over all other alternative investment strategies lies in its focus on securing a standard market financial return. Only impact investing allows ecological or social investments to be made genuinely profitable and thereby sustainable.

Other companies of the 4L family

Project Investments and Partners

Network

We work together on rethinking economic concepts and on social, societal and ecological change in our society.

Bundesinitiative Impact Investing e.V., Berlin

bwcon, Baden-Württemberg

Cyberforum e.V., Karlsruhe

Fair Finance Institute, Heidelberg

TechnologieRegion Karlsruhe GmbH, Karlsruhe

TONIIC Institute, San Francisco